- Brex Startup Community Weekly Newsletter

- Posts

- The J-curve simplified

The J-curve simplified

Navigating the ups and downs of early investment years

Happy Tuesday Brex community,

Comprehending the "J-curve" in venture capital is pivotal for founders. This financial phenomenon, akin to a powerlaw, represents the typical return pattern. In the early stages, when a venture capital fund is initiated, it often records negative returns due to upfront capital and acquisition expenses. However, as time progresses, portfolio companies gain value, reversing the trend and ultimately generating positive returns, forming an upward curve resembling a "J." For founders, grasping this concept is vital as it provides a realistic outlook. Patience and a long-term vision are essential when navigating the world of venture capital, where initial years may not yield immediate positive returns. Understand venture economics before going out to market! Our team is happy to offer assistance with benchmarking term sheets, guide you through due diligence preparation, and conduct practice investment committee sessions.

If you just closed a VC round and interested in becoming a new Brex client, we have an offer of $1K cash back if you sign up by month end, email [email protected]

Growing together, Michael Morgenstern

Upcoming Events:

Brex Supper Club NYC 2/6

Designed as a private dinner series for founders in NYC

Apply Here Brex Host: Erica Wenger

Brex Supper Club w/ Las Olas Venture Capital Fort Lauderdale 2/7

Designed as a private dinner series for seed stage B2B founders

Apply Here Brex Host: Michael Morgenstern

Brex Supper Club w/ Link Ventures Boston 2/8

Designed as a private dinner series for founders building in the AI space

Apply Here Brex Host: Shai Goldman

Brexfast Club and CoWorking w/ Codi

Designed a breakfast and day of community coworking for founders.

Apply Here Brex Host: Jonathan Chang

Brex Supper Club/ VC in DC 2/20

Designed as a private dinner series for GPs of DC Area VC funds

Brexfast Club w/ VC in DC 2/21

Designed as a community breakfast for Associates, VPs, and Principals of DC Area VC funds

Apply Here Brex Host: Michael Morgenstern

Brex Supper Club NYC 2/26

Designed as a private dinner series for founders in NYC

Apply Here Brex Host: Erica Wenger

Startup of the Week 🤩

Dori Yona, Co-founder & CEO Simple Closure

SimpleClosure offers founders a turn-key solution for dissolving and closing a company in a compliant and responsible manner. Their mission is to minimize the costs, time and pain that stem from the mandatory processes required to shutdown a corporate entity in the US.

SimpleClosure automates almost all of the legal, fiduciary, financial and tax-related tasks involved in dissolving a business, granting founders the peace of mind to focus on the future without fear of accruing fines and penalties.

Since coming out of stealth in the summer of 2023, SimpleClosure has helped many founders shutdown successfully, from initial board resolutions to the final dispersion of funds to investors.

Ambassador’s perspective: SimpleClosure addresses a critical pain point for founders but also reduces the risk of accruing fines and penalties associated with non-compliance. Every year >700k businesses shut down. Business failure is part of a vibrant ecosystem and SimpleClosure is solving a perpetual market painpoint. If they get the pricing right, this should be a large business.

Emerging Manager Spotlight 🤩

Rishi Patel General Partner at PlusEight Equity Partners

PlusEight Equity Partners is an early stage venture capital firm that has partnered with electronic music industry leaders to invest in startups at the intersection of entertainment & technology. The firm is co-founded by techno luminaries Richie Hawtin and John Acquaviva alongside Wall Street veteran, Rishi Patel.

Plus Eight Equity Partners works closely with Company Founders to navigate through the complexities of the entertainment industry to enhance their business opportunities through strategic guidance, networking and personal mentorship. Since inception in 2014, Plus Eight has met with over 2,500 companies in the ecosystem seeking to raise capital. Today, Plus Eight’s investment portfolio consists of 13 companies across North America and Europe. Plus Eight Equity Partners is headquartered in Miami, USA with offices in Ibiza, Spain.

🧵 I hosted 14 NYC Seed and Series A VCs for a breakfast. Here’s what they are saying

What are you seeing at the Series A?

- Series As are hard because it’s hard to compare to the flat rounds from the 2021 vintage with $5M+ ARR who are doing Series A+’s

- Many are avoiding… twitter.com/i/web/status/1…— Henri Pierre-Jacques (@hpierrejacques)

2:05 PM • Jan 24, 2024

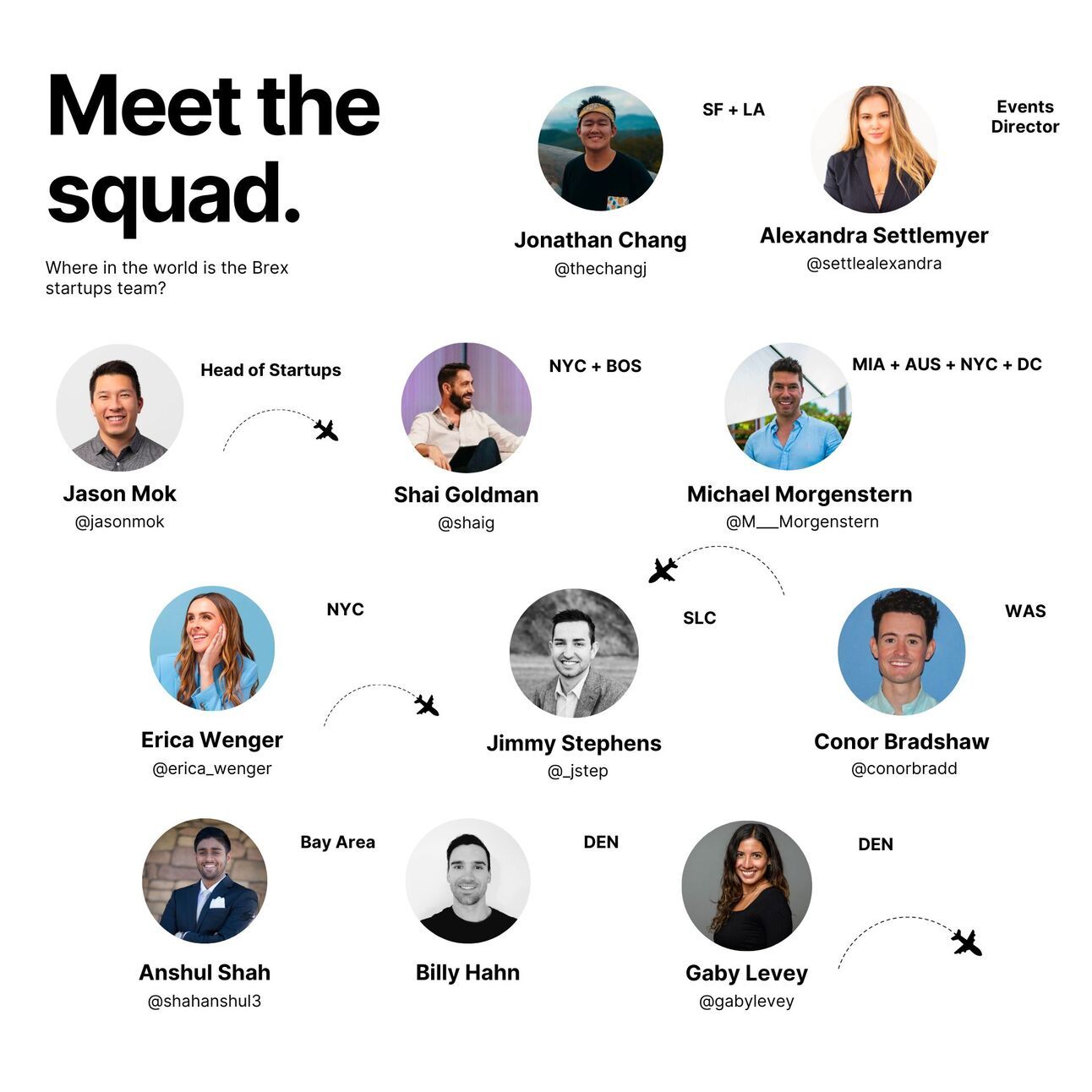

Connect with us

Alexandra: [email protected] | Twitter

Anshul: [email protected] | Twitter

Billy: [email protected]

Conor: [email protected] | Twitter

Gaby: [email protected] | Twitter

Erica: [email protected] | Twitter

Jason: [email protected] | Twitter

Jimmy: [email protected] | Twitter

Jonathan: [email protected] | Twitter

Michael: [email protected] | Twitter

Shai: [email protected] | Twitter

The financial stack that scales with you. 🤩 Trusted by 1 in 4 US startups, Brex allows you to manage your spend from MVP to IPO. Interested? Sign up here using the referral code NEWSLETTER and get 30,000 bonus points, $5K AWS credits, $2.5K OpenAI credits and up to $150K in SaaS discounts.

Don’t hesitate to reach out,🦾!

Startups Team @ Brexsdf